Linklease was formed to begin tackling the estimated $40 billion regional equipment financing gap in the Middle East. Equipment leasing originated in the region (ancient Mesopotamia) 4000 years ago, when landowners leased basic farming equipment to workers to tend the fields. The right to own this equipment over time gave a sense of purpose to the work and workers took better care of the equipment. It was codified into law by King Hammurabi 250 years later.

Fast forward 4000 years and equipment leasing is the basis of most modern economies, but it didn’t take off in the Middle East. The World Bank in 2014 put Equipment Leases as <5% of transactions in the region, compared to >33% in the USA, Europe and Asia.

The abundance of wealth together with the ability to borrow against balance sheets meant that equipment was purchased out-right through until 2010.

As liquidity dried up and companies became asset rich/cashflow poor, CFO’s have had to look for alternative solutions to fund their equipment needs, for which the solutions are not yet properly embedded.

Enter Linklease. A group of seasoned finance professionals with extensive market experience who have made it their mission to build a leasing platform that allows end lessees to access a wide spectrum of equipment.

Linklease caters mainly to small and medium size companies in sectors such Healthcare, Clean Energy, Logistics, lifting to name a few, but also works with larger international blue-chip institutions in Telecoms.

The problem: –

The COVID crisis has made it more unlikely that good credit worthy businesses in the SME space will be able to access the equipment they need through traditional loans via banks and finance providers; increasing the pipeline of business routed through Linklease.

Our Opportunity: –

This is an unprecedented time of opportunity for Linklease, meaning that our major challenge is keeping up with the funding demand.

Far from the world coming to a stop, we have been funding Liquid Nitrogen storage tanks, Electric vehicles and building a pipeline in some sectors that are counter cyclical or Covid Neutral such as Medical Imaging Equipment. There are many aspects of the economy that continue during turbulent times and being able to look through to underlying sectors and even companies is an important skill set, a craft learnt over years of working for larger Banks and finance companies.

Linklease is funded by a $500m Bond Programme setup issued via the Frankfurt Bond Exchange and such is the pipeline of new transactions, that a second series of our Bond was launched in July 2020, right in the middle of the pandemic period.

Creating an investment vehicle that is an attractive fixed-income product secured by tangible assets in the Middle East; a real first in class. It is true foreign direct investment into the Middle East from investors all over the globe who are moving away from equities to products with a more predictable return.

Covid Relief Reserve: –

Typically, in a period of stress, leasing & finance companies call in their Assets and brace for the impact. Early on, in fact from March, realising that globally everyone was in the same position, we decided to make a change and swim with the tide and rather than act punitively – we created a Covid Relief Reserve.

As already explained, we are financed independently, so we & our clients don’t qualify for government support during lockdown. But it made sense to find a way to support our loyal clients, where we possibly could and build stronger relationships during difficult times.

Where clients were facing genuine pressure, we were able to purchase additional equipment from them from our Reserves in a sale & lease-back structure. This provided well needed liquidity to them, allowing them to not only cover their lease payments to us, but to continue to pay other important bills within their business.

The positive results can be measured qualitatively and quantitively, it’s a win for the client who get a break on their payments, a win for our staff who aren’t having to put pressure on their client relationships during a period of pressure largely outside of their control and it’s also a win for us as we extend leasing terms to clients who have a track record with us.

There are a few other small actions with big wins too, we’ve picked up some great staff who have become available from larger companies who wouldn’t ordinarily have been available to us, so we’ve ramped up our experience load during this period and finally, we’ve by continuing to book leases, we’ve had first bite of the cherry at bigger deals.

We’re already leading the way in innovation by being the first ‘true’ Leasing company in the Middle East, offering multi sector leases matched with hi-tech tracking, GPS & RFID solutions. So, our next big thing will be geographic expansion beyond the region.

We are already established in Africa and will be writing our first leases in before the end of 2020. It is a natural next geographic step for Linklease in its evolution. Obviously, it’s a close market and already has good trading links, but also it is a thirsty market for equipment.

Infrastructure development, road building, lifting and logistics are risk-on in the Sub Saharan belt and Linklease is well positioned to provide leasing services, new equipment through its links with distributors and pre-used equipment from the over-supply within the GCC.

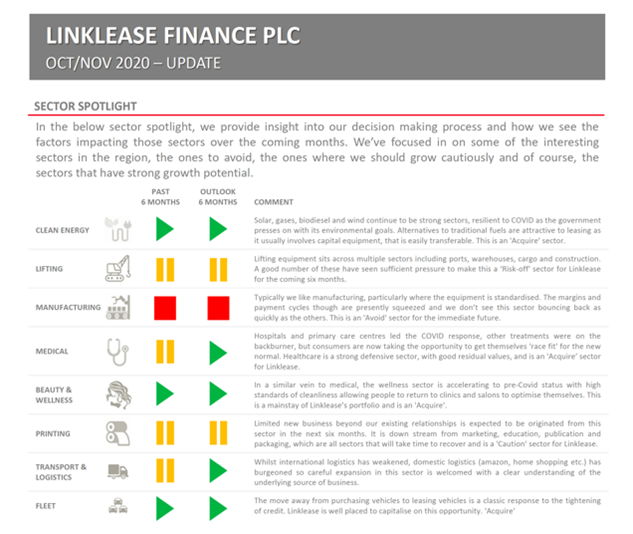

There’s a lot to say on this subject, all our top team are from international banks and have a strong track record in quality. But where I think we have something interesting to say is our market reports (see image). We issue sector updates showing our insight into the performance of sectors and which sectors we think are risk-on and risk-off over the next 6 months. This gives investors, clients and market observers a snapshot of the depth of our understanding of the market and as the only real Leasing company in the market, it is providing something of a trail of breadcrumbs for others to follow.

We encourage others to follow us into the leasing market, this will have the effect of bringing down the cost of funds available to us & increasing the overall quantum which will make leases even more affordable to the end lessee.

Being the first the first to do something is a good feeling, but a temporary one, King Hammurabi will tell you that. Its only worthwhile if you lay a course for others to follow and help develop it into a sustainable market that ultimately benefits the economy, eats into the $40bio equipment gap and if we do our job right, as the first to market we’ll gather our natural share.