Revenues arrived a day late and a dollar short in 2020 as COVID-19 hit hard across global economic sectors. Long and unprecedented lockdowns and economic closures halted all but a fraction of usual business activities and industries, including the insurance sector.

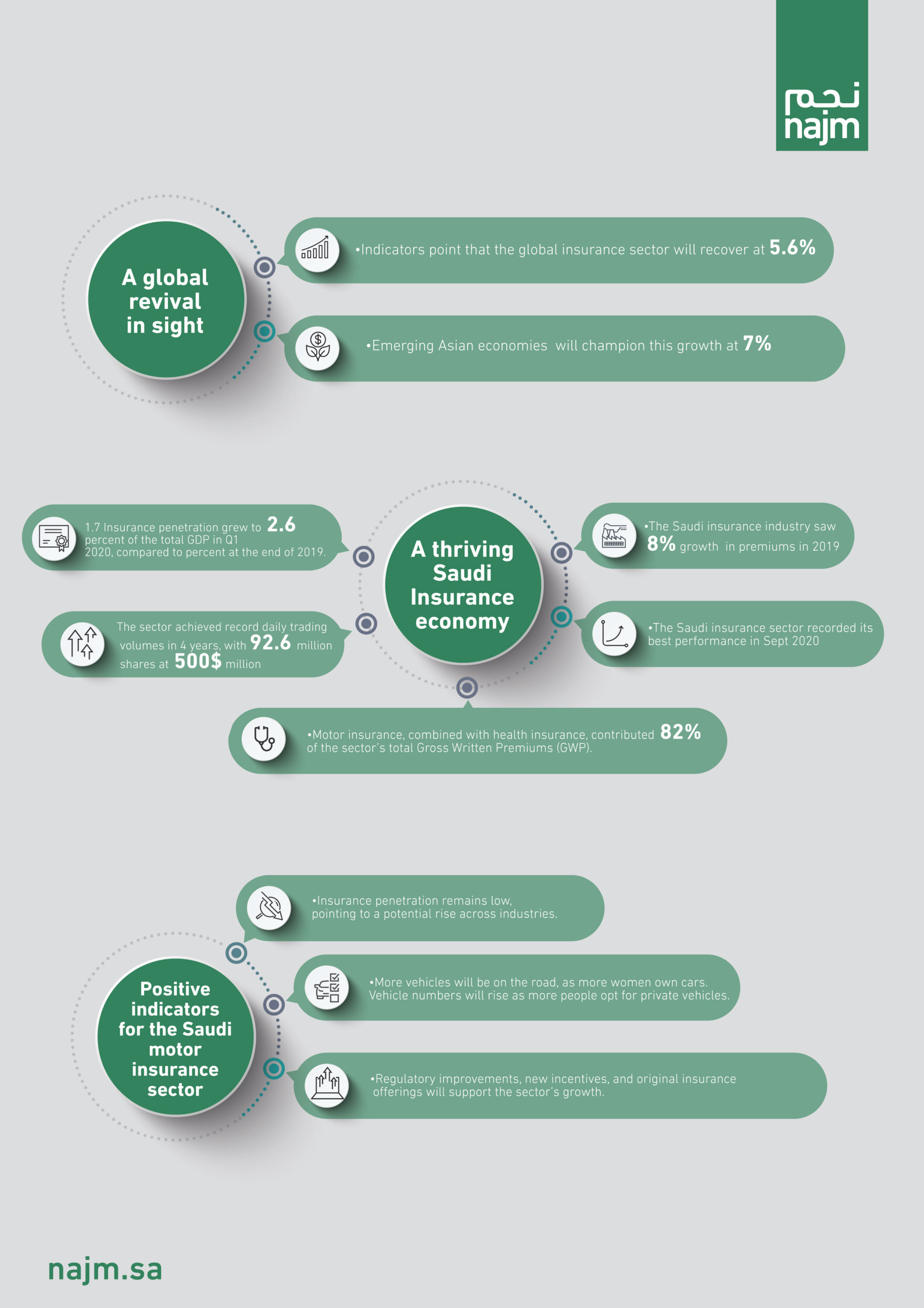

Luckily, this stumble has mostly passed and is being replaced by a gradual revival, led by emerging Asian economies forecasted to grow at 7% in both life and non-life premiums over the next year, compared to a global figure of 5.6 percent.

Saudi Arabia, the region’s leading economy and home to Vision 2030, especially enjoys remarkable prospects for a strong comeback across industries as it pursues a comprehensive reformative plan encompassing the diversification of non-oil revenue resources and the improvement of the quality of life for citizens and residents through digitalization, investments, and ambitious mega-developments.

Prior to the pandemic, the Saudi insurance industry saw an impressive total growth in premiums by almost 8 percent in 2019. Generally, insurance penetration in the Kingdom still remains relatively low, pointing to a potential rise similar to the trend measured between 2014 and 2019, during which it grew at a rate of 12 percent.

Moreover, swift and diligent measures introduced by the Saudi leadership and the private sector have already started to pay off. In September this year, the Saudi insurance sector recorded its best performance in two months in the Saudi stock market, topping its 2017 peak. The sector also recorded its best daily trading volumes in over four years, about 92.6 million shares, at a value of $500 million. Recent reports published by the Saudi Arabian Monetary Fund (SAMA) state that insurance penetration grew to 2.6 percent of the total Saudi GDP in the first quarter of 2020, compared to 1.7 percent at the end of 2019.

The motor insurance industry was among the most affected during the pandemic, as traffic plying on the roads was significantly reduced. Aggravating the situation was a lack of new vehicle purchases, which slashed a major portion of insurance premiums. Yet, recovery is in plain sight. This sector in particular plays a major role within the Saudi insurance sector, as it has, combined with health insurance, contributed a whopping 82% of the sector’s total Gross Written Premiums (GWP) in 2019, and has also enjoyed a turnover of $2.29 billion during the same year.

What’s more, with half of vehicle owners yet to obtain coverage, a surge in demand is already taking shape and highlighting the potential boost this lively sector will offer to the Saudi economy, especially in light of more women owning cars, and the expectation that more vehicles will be on the road with people opting for private vehicles as opposed to shared rides or public transportation, due to a perceived lower risk of infection.

In fact, the expected rise in demand is also supported by regulatory improvements, including better enforcement of the compulsory vehicle insurance act, alongside new incentives and original offerings provided by insurance entities. Among them is the recent 10% discount on compulsory insurance policies, and 15% on comprehensive insurance policies, which have been added to the markdowns granted as per the instructions of SAMA.

In parallel with the projected increase in demand, COVID-19 might have actually done a favor for the motor insurance sector in the long run, by speeding up its quest to adopt a comprehensive digitalization and automation strategy, and elevating the standard of its services. Najm, a pioneer and first-mover in responding to the crisis, achieved a stellar digitalization rate of 95% across all its services in 2020 through strategically optimized investments. As testament to this success, Najm’s digital branch, including Najm App and website, is being increasingly utilized by individual and corporate clients to upload insurance claims, damage claims, and review procedures, and has witnessed a total of around 425k downloads between January and September 2020.

On an operational level, the employment of automation and innovation has translated into higher service delivery efficiency and more rapid accident reporting, where a surveyor would arrive on site in 25% less time when an accident is reported through the app rather than the traditional call center.

Najm is also focusing on restructuring, modernizing, and improving its business processes by adopting BASE, its new innovative strategy aimed at operating digital technologies and customer experience metrics, namely the Net Promoter Score system, to streamline operations and measure their impact in line with best global practices that ensure customers enjoy the best possible service.

Backed by the genuine efforts of the Saudi leadership to attain more economic diversification, the Saudi motor insurance sector is firmly back on its feet, and is pursuing a steady journey towards fulfilling the targets of Saudi Vision 2030, empowered by a robust digital infrastructure, a comprehensive operations ecosystem, rising demand, and customer trust, all of which will ultimately position the Kingdom of Saudi Arabia at the forefront of this vital industry.